I always get the question asked “How can I make money in Real estate?” and the most obvious answer is by buying low and selling high. It works like most other commodities except that there are other related and ancillary sources that some know about such as Rent, but there are other ways that might not seem immediately obvious from the outside looking in.

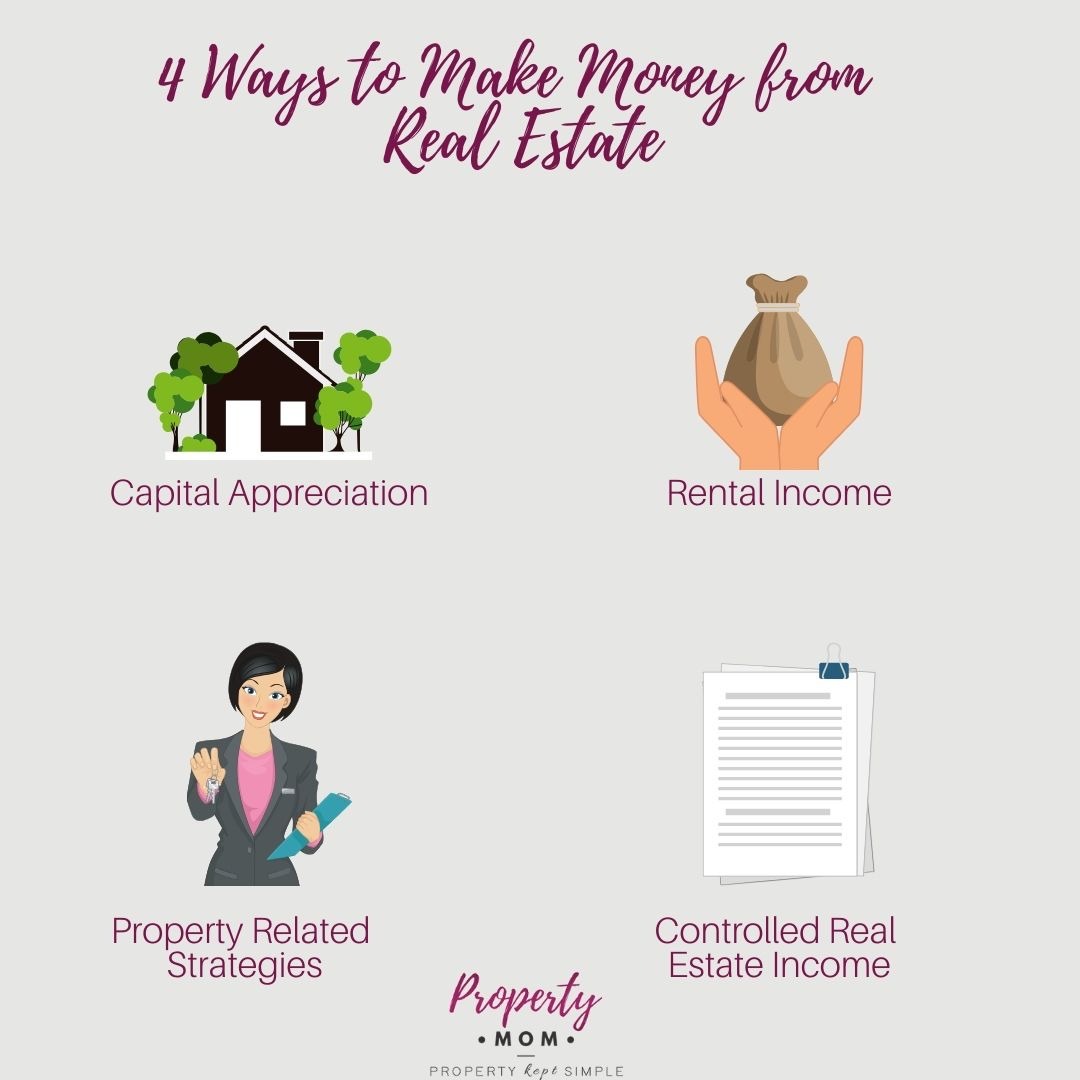

That was certainly my experience when I got into Real Estate thinking that the main source of income would be from flipping properties or buy-to-hold rental strategies, but since then, I have come to understand that there are 4 main categories that people make money or earn an income in Real estate. The different strategies, ventures and creative structures mainly fall under these following:

1. Capital appreciation

This is the most common and obvious way to make money through investing in property. It’s the traditional way of buying a property and owning it for long enough to increase in value over the years owned. In its simplest form, a buyer selects a property in a location they know has growth potential either because it’s close to amenities, a strong city base, transport, schools etc. It could be a home, residential or commercial investment property.

(By the way, your actual home is deemed a liability as you don’t earn income from it, but at least buying the right property means you can gain significantly when you sell it and if you buy at the right time and can get the capital growth during the period you live there).

The drawback to this method if just applied without any “creativity” is depending on your location, you usually need to hold for a considerable amount of time to reap the rewards, especially if you buy at the top of the market (when prices are high). Also, if you have taken out finance or a mortgage, you need to be certain that you will not need to sell earlier than anticipated. This is especially true (and harrowing) if you need to sell during a market downturn and your property value has fallen into negative equity (which means the value has fallen below the amount you borrowed). But even with these potential risks, it’s one of the safer options when it comes to growing your wealth.

There are also more complex strategies and ways to FORCE APPRECIATION up to almost gain immediate value from some selected types of property and very popular with property investors, but that’s a different topic to be discussed in another post.

2. Cash Flow Income

This is where your property investment provides monthly income from rent. Whether from a single tenant/family or for employing more aggressive cashflow strategies from converting to Houses of Multiple Occupancy (HMOs) or Serviced Accommodation (Furnished Holiday Lets) and earning the cashflow that derives from the property. For larger real estate investments, such as an apartment building, you can operating it, and earn from collecting service charges etc. Cashflow can also be generated from other types of real estate such as commercial real estate, storage units, office buildings, industrial and retail establishments etc.

3. Real Estate Related Income

This income is generated by direct property related services provided to specialists in the real estate industry, such as real estate agents, who earn commission on properties they help a client buy or sell, or real estate brokers who arrange financing for properties and management companies, who keep a percentage of the rental income in exchange for running the day-to-day operations of a property or providing real estate services as described. Creating building maintenance and support. For some real estate investments, this can be a good source of income.

It can include ancillary real estate services such as maintenance services, concierge services, Design related services, income from other things such as vending machines inside office buildings or laundry related facilities in larger rental apartments. In effect, they serve as mini services or businesses within the wider real estate industry that allow you to make money from a captive customer such as providing services to the tenants at the property or the landlord who owns the property.

I cover a number of these strategies in my post covering 14 different property related services that requires little money to set up.

4. Controlled Real Estate income

This is where you gain almost complete control of the property by coming up with an arrangement such as a lease to OWN the property or a lease to RENT and then either rent it out and earn the monthly difference between what you earn and what you need to pay the landlord. In the Lease to rent, you act as a tenant at the property which the right to sublet the property for profit. This could be to single families on a long or short term basis or individuals rooms split up to generate higher rental differential from what you pay the landlord as rent.

The Lease to own arrangement allows you to control the property and refurbish it if required with the aim to sell on to a buyer looking to pay a higher price than the lease arrangement you have with the existing owner. For example, you agree the lease option to purchase the property for £200,000 with the hopes to sell on for at least £220,000 and then make the profit. Clearly, you will need to find a distressed buyer or a distressed property for this strategy to work.

Both strategies are a great way to control a property without owning it and generate great returns from your arrangement with the owner/managing agent.

You can find more of these strategies HERE.

I always aim to keep property as simple to grasp but with good useful information, so do feel free to message me for any questions or if you want to find out more information about this post.

Always seek out specialist advise for any investments you make.

Disclosure: This information is provided to you as a resource for informational purposes only. It is being presented without special consideration of your investment objectives, financial circumstances or risk tolerance of any specific investor and might not be suitable for your investment. Investing involves risk including the potential loss of the principal capital. This information is not intended to, and should not, form a primary or single basis for any investment decision you make. It is good practice to always consult your own legal, tax or investment advisor before making any investment, financial planning and tax considerations or decisions